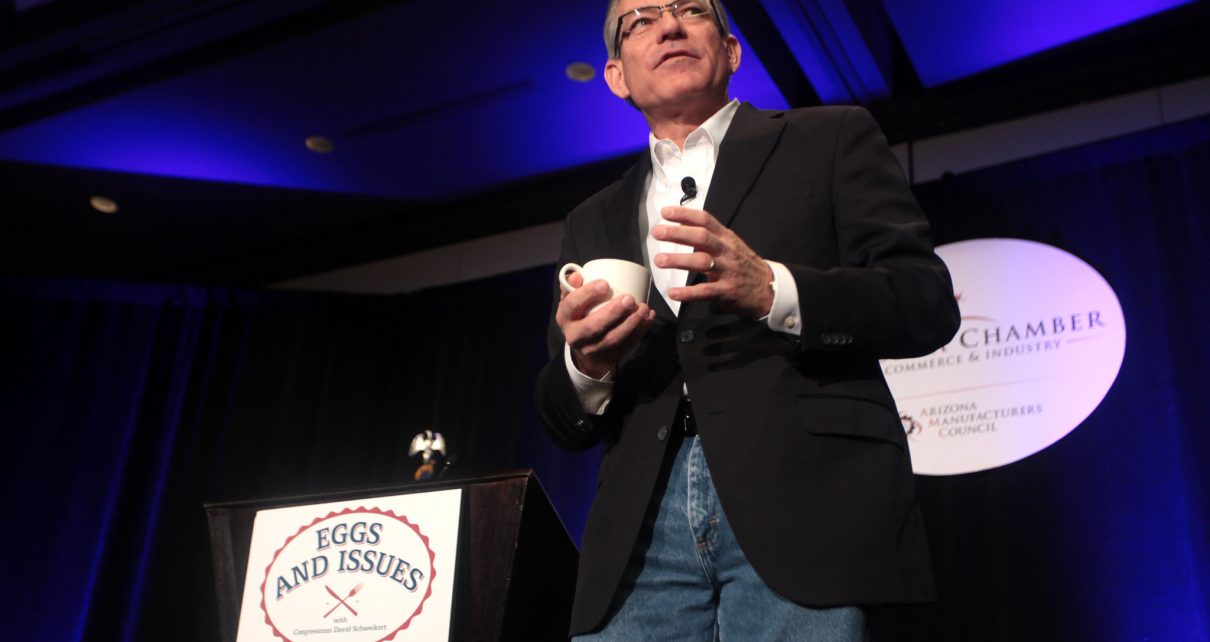

Congressman David Schweikert speaking at an Eggs & Issues breakfast hosted by the Arizona Chamber of Commerce & Industry in Phoenix, March 10, 2015. (Photo: Gage Skidmore)

Schweikert, Ciscomani, and Stanton Join AZ Battle Against IRS Rebate Penalty

Conress members back Mayes’ tough talk against IRS money grab

By Steve Kirwan, March 18, 2024 10:06 am

Congressional members David Schweikert (R-CD1), Juan Ciscomani (R-CD6), and Greg Stanton (D-CD4) join AZ’s Democrat AG Kris Mayes and Governor Katie Hobbs to form a bipartisan wall against the IRS grab for Arizona’s family tax rebate. On January 27, 2024, Arizona Globe reported on AG Mayes’s threat to take legal action if the IRS moved to tax the Republican legislature’s tax rebate. And now, the big guns have stepped in to back the state in its attempt to ward off the IRS.

In a letter dated March 13, 2024, the three present their arguments against the IRS decision to tax the rebate that the state passed to battle the debilitating inflation caused by the Biden Administration’s disastrous economy.

The letter states, “We urge the IRS to reconsider its determination and provide expedited relief to compliant Arizonan taxpayers who have already filed their 2023 tax returns. The country is poorer now than it was three years ago, and Arizonans are no different, facing the brunt of financial pressure with supermarket prices now nearly 25% higher than in January 2020, for example. State officials acted in good faith with the reasonably available information to provide more than 700,000 households with much-needed relief from price increases on everyday goods and services.”

The letter continues, “In December 2023, the IRS relayed its decision orally through a video meeting, providing no written explanation until February 15, 2024, eighteen days after the start of tax season, and only in response to a letter from the Arizona Attorney General challenging the decision.”

If not stopped, the IRS is poised to confiscate an estimated $20.8 million in federal taxes, all due to the unequal application of a prior decision to ignore rebates and payments from 21 states. The letter addresses that concern, too.

“The inconsistency and delay in communication have resulted in undue financial strain on Arizonans,” they wrote.

It remains to be seen whether the action taken by the congress members will reverse the IRS’s plan. If not, it’s likely to result in legal action by the state. And there is a potential political price as well. The decision could have far-reaching implications in an election year, especially now that Arizona is a “swing state” teetering on the edge of turning from purple to red. And, with April 15th looming on the near horizon, a decision must come sooner than later.

You can read the letter to the IRS here.

- Bolick Animal Cruelty Bill Passes Legislature Despite GOP Concerns - June 25, 2025

- Montenegro Declines to Comment on Lack of Ethics Complaints - May 30, 2025

- Honoring the Sacrifice: A Reflection on Memorial Day - May 26, 2025